Public Housing Authority Update

KeyBanc Capital Markets is a trade name under which corporate and investment banking products and services of KeyCorp and its subsidiaries, KeyBanc Capital Markets Inc., Member FINRA/SIPC, and KeyBank National Association (“KeyBank N.A.”), are marketed. Securities products and services are offered by KeyBanc Capital Markets Inc. and its licensed securities representatives, who may also be employees of KeyBank N.A. Banking products and services are offered by KeyBank N.A.

KeyBanc Capital Markets Inc. is not acting as a municipal advisor or fiduciary and any opinions, views or information herein is not intended to be, and should not be construed as, advice within the meaning of Section 15B of the Securities Exchange Act of 1934. Key.com is a federally registered service mark of KeyCorp. ©2019 KeyCorp

Market Snapshot

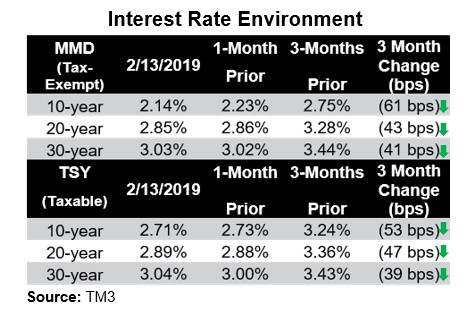

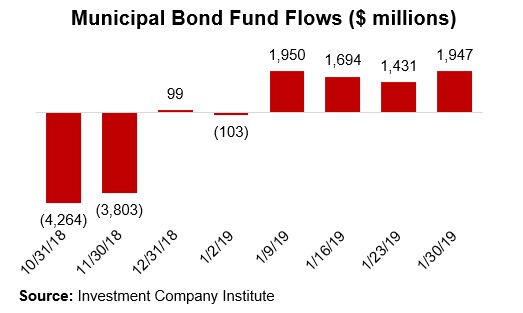

Bond Markets responded favorably to the Federal Reserve’s relatively dovish forward guidance following its December meeting (where it raised the benchmark Federal Funds rate for the fourth time in 2018). Benchmark taxable and tax-exempt yields have decreased up to 50 basis points in select spot maturities since highs seen in November due to general fears of a worldwide economic slowdown. Fanning those fears are consistent releases of disappointing economic data from China and the Eurozone; in particular, investors place China’s GDP deceleration (6.4% for the fourth quarter of 2018, the lowest in recent years) and uncertainty about global demand for commodities such as oil and copper as potential leading indicators for global malaise. Domestically, a strong decline in existing home sales in December, despite relative decreases in mortgage rates from 2018 highs, has the potential to affect overall home prices, as homebuyers seem to finally be balking at all-time high real estate prices. These highs, exacerbated in hot markets like Seattle, Denver, and San Jose, have led large companies such as Microsoft to publicly pledge support for affordable housing initiatives.

Industry News

New Borrowing Trends: Typically, Public Housing Authorities (PHA’s) have issued debt legally secured by a property and its ability to pay debt service from project revenues. As many PHAs have grown more sophisticated and have ever increasing needs for limited resources, a new method of borrowing, including permissible General Authority Revenues, has given Public Housing Authorities access to the tax-exempt capital markets via Public Bond Offerings. These offerings can often significantly lower the cost of capital compared to bank loans/placements and can often be considerably less costly. Based on the credit strength of the PHA, two financing options may be available:

- Option 1 – General Authority Revenues: A PHA may disclose detailed information and history relating to its overall General Revenues, which allows it to issue bonds based on this pledge alone. King County Housing Authority, Chicago Housing Authority, and the Housing Authority of the City of Los Angeles have issued debt in the past year based primarily on this pledge and had strong access to capital markets for long-term bonds at low interest rates.

- Option 2 – Deed of Trust: A PHA can also issue debt primarily secured by net revenues of a particular project or group of projects. In order to secure these revenues, the PHA will tie the revenues to a Deed of Trust, which places limits on what can be done with each property in the future to satisfy bondholders looking for yearly revenue streams. PHAs often also include a General Revenue Pledge to secure a lower interest rate on its debt.

KBCM Transaction Spotlight

- Issuer Name: King County Housing Authority

- Security: Authority’s General Revenue Pledge, Deed of Trust, Credit Enhancement with King County, WA

- KBCM Role: Sole Manager

- Closing Date: April 18, 2018

- Par Amount: $164,710,000 (two series)

- Term: 20 years

- Blended Bond Yield: 3.74%

- Tax Status: Tax-exempt

Projects: The Authority’s overall $164 million financing plan was split into two simultaneous issuances. The proceeds from the $90 million portion of the Ballinger Commons issuance (Rated ‘AAA’ by S&P, enhanced by the County) were used to refinance, in part, the costs of purchasing a 72-acre apartment complex in 2017, which was originally obtained with funding secured by a short-term note provided by KeyBank. The remaining $74.71 million of bond proceeds (Rated ‘AA’ by S&P, based on the Authority’s Credit Rating) were used to refund a portion of the Authority’s existing debt and to help with rehabilitation work to each of the properties associated with those refunded lines of credit.

Security: The $90 million of Ballinger Commons Apartments Bonds are secured by the General Revenues of the Authority as well as the Credit Enhancement Agreement entered into by King County and KCHA. The $74.71 million of Pooled Housing Bonds are secured by Deeds of Trust on the Projects and a General Revenue Pledge from the Authority.

Other Select Recent KBCM Affordable Housing Transactions (Red Identifies PHA Transactions)

How Can KBCM Help?

- Analytical approach

- Identify/evaluate financing solutions

Contact:

Anthony Pass, Vice President

206-343-6969

anthony.pass@key.com

Contact:

Sam Adams, Vice President

614-460-3416

sam.adams@key.com

KeyBanc Capital Markets is a trade name under which corporate and investment banking products and services of KeyCorp and its subsidiaries, KeyBanc Capital Markets Inc., Member FINRA/SIPC, and KeyBank National Association (“KeyBank N.A.”), are marketed. Securities products and services are offered by KeyBanc Capital Markets Inc. and its licensed securities representatives, who may also be employees of KeyBank N.A. Banking products and services are offered by KeyBank N.A.

KeyBanc Capital Markets Inc. is not acting as a municipal advisor or fiduciary and any opinions, views or information herein is not intended to be, and should not be construed as, advice within the meaning of Section 15B of the Securities Exchange Act of 1934. Key.com is a federally registered service mark of KeyCorp. ©2019 KeyCorp

More Articles in this Issue

Award of Excellence: Lincoln Place

The Vancouver Housing Authority (VHA) wins a 2018 Award of Excellence in Affordable Housing for creating Lincoln…Using Public-Private Partnerships to Fund Affordable Housing

The Housing Opportunities Commission of Montgomery County (HOC) wins a 2019 Award of Excellence in…Award of Excellence: Cosecha Court

The Yakima Housing Authority (YHA) wins a 2018 Award of Excellence in Affordable Housing for using seasonal…Award of Excellence: 3600 Spenard

The Cook Inlet Housing Authority (CIHA) wins a 2018 Award of Excellence in Affordable Housing for the…Housing as a Platform for Serving Residents

Federal safety net programs are intended to protect the most vulnerable Americans—such as the elderly,…Lean-ing Into Good Change: An HCV Success Story

The Housing Authority of the County of Santa Barbara (HASBARCO) wanted to improve their Housing Choice Voucher (HCV) program…