Housing Vouchers Have Helped Tenants and Landlords Weather the Pandemic

This post was originally published on Urban Wire, the blog of the Urban Institute.

Many families have faced challenges paying rent during the pandemic, and landlords, especially mom-and-pop landlords, have struggled to make their housing payments as their rental income decreased. The pandemic has disproportionately affected low-income renters and Black and Hispanic mom-and-pop landlords, who are more likely to rent their properties to low-income households. Rental assistance can alleviate financial stress, but our latest survey with Avail shows that most landlords and tenants are not aware of government rental assistance, and very few have received it.

Vouchers provided through the federal Housing Choice Voucher Program can help low-income families afford rent even when they experience income disruptions. But many landlords have never accepted vouchers, potentially because of program requirements or lack of awareness of the program. During the pandemic, however, receiving vouchers may become more attractive to landlords because vouchers guarantee a portion of the rent will be paid by the public housing authority, regardless of the tenant’s financial circumstances.

In February 2021, Avail, an online platform serving do-it-yourself, mom-and-pop landlords, surveyed their landlords and tenants about circumstances during the pandemic, including questions about vouchers. More than 1,200 landlords and 2,500 tenants responded.

Our analysis of the survey results found that tenants with vouchers owe less back rent, and landlords have had positive experiences with voucher holders. These results suggest vouchers have helped tenants and landlords weather the pandemic’s financial effects. Program improvements and efforts to boost awareness could help even more tenants and landlords benefit from vouchers.

Voucher holders owe less back rent

Low-income renters and renters of color are more likely to have vouchers. In the Avail survey, 74 percent of voucher holders had annual household income less than $25,000, while 29 percent of those without vouchers were in this income range. Five percent of Black tenants said they pay rent using vouchers, compared with 3.4 percent of Hispanic tenants and 2 percent of white tenants.

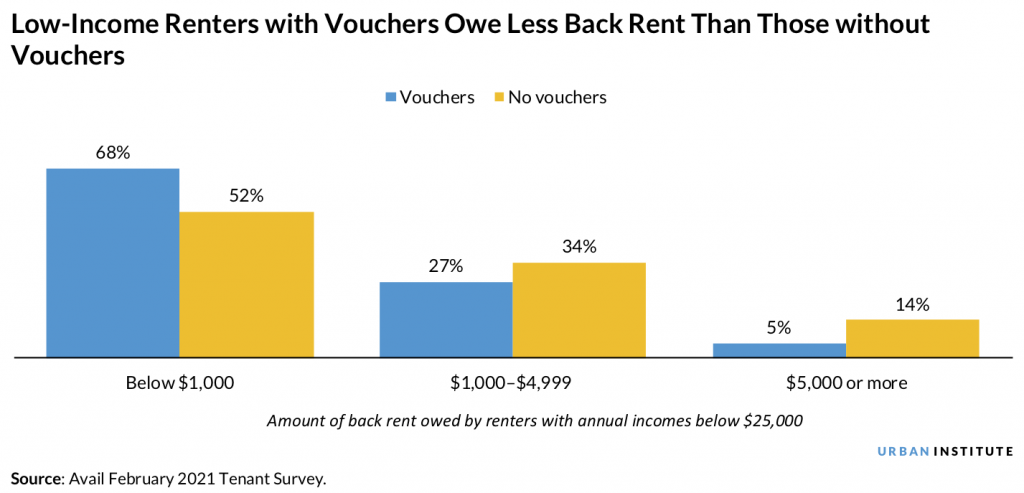

We examined the amount of back rent owed by low-income tenants (those with less than $25,000 in household income) and found that those with vouchers owe significantly less back rent. Sixty-eight percent of low-income tenants with vouchers owe less than $1,000 in back rent (including those who owe none), compared with just over half of those without vouchers. No households with vouchers owed more than $15,000 in back rent, compared with 2 percent of those without vouchers.

Most landlords who accepted vouchers had a positive experience renting to tenants with vouchers

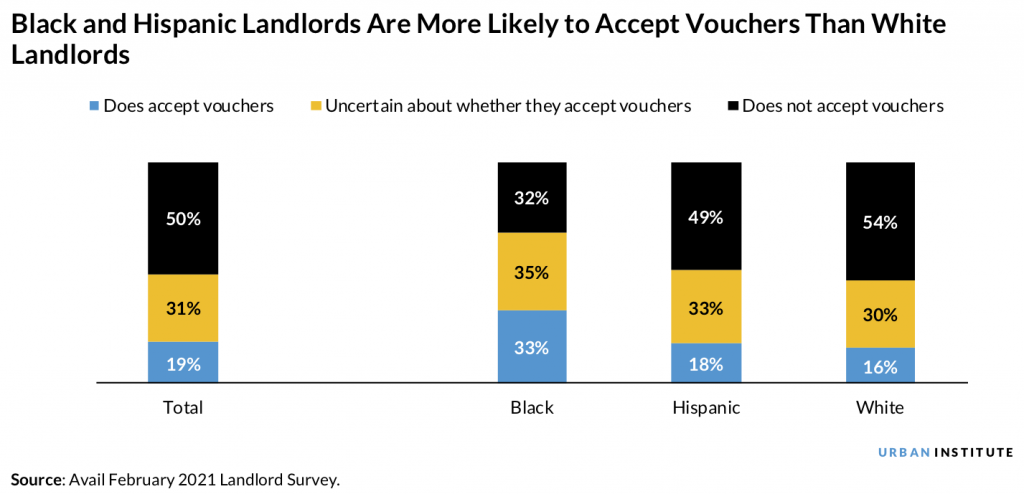

The share of landlords who have tenants with vouchers is low overall (19 percent) but is higher among Black and Hispanic landlords. Thirty-three percent of Black landlords accept vouchers, compared with 18 percent of Hispanic landlords and 16 percent of white landlords.

Overall, landlords who already accept vouchers said they had a positive experience renting to tenants with vouchers. Eighty percent of Hispanic landlords, 77 percent of Black landlords, and 69 percent of white landlords expressed their experience with voucher holders was positive.

Additionally, about a third of landlords who already accept vouchers said the pandemic has made them even more likely to accept vouchers. Sixty percent of Hispanic landlords, 35 percent of Black landlords, and 33 percent of white landlords said they were now more likely to rent to tenants with vouchers, while none of the Black or Hispanic landlords said they are less likely to rent to voucher holders.

The pandemic has not shifted the preferences of landlords who don’t accept vouchers

On the other hand, the 50 percent of landlords who don’t accept vouchers were more likely to say their perceptions toward vouchers became more negative because of the pandemic. Only 5 percent of these landlords said they were more likely to rent to voucher holders, while 22 percent said they were less likely. The remaining landlords said their perceptions were unchanged. Black and Hispanic landlords were more likely to say their perceptions of vouchers became more negative (23 percent and 24 percent, respectively) compared with white landlords (18 percent).

Among the 31 percent of landlords who were uncertain about whether they would accept vouchers, more landlords said their perceptions of vouchers became more positive since the pandemic than said their perceptions became more negative. Overall, 16 percent of these landlords said they were more likely to accept vouchers, 8 percentage points higher than those who said they were less likely. Black and Hispanic landlords were more likely to say their perceptions of vouchers became more positive (22 percent and 21 percent, respectively) compared with white landlords (16 percent).

Policymakers can improve the voucher program and increase awareness among landlords

Avail survey responses show that tenants with housing vouchers and most landlords who accept vouchers had a positive experience with the program and that vouchers helped both groups during the pandemic. Yet because of funding shortfalls, only one in five renters who are eligible for federal housing assistance receives it. Expanding funding for the Housing Choice Voucher Program could enhance housing stability for many low-income renters and could reduce the amount of assistance needed during an economic downturn.

Along with such an expansion, policymakers can streamline the regulations associated with vouchers to increase the willingness of mom-and-pop landlords to accept them. In the Avail survey, about 40 percent of landlords said they do not accept tenants with vouchers because of the complex rules surrounding the program, 29 percent said they do not want to deal with the ongoing property inspections, and 20 percent said it takes too long to get approval to accept tenants with a voucher.

A lack of information also deters independent landlords from accepting tenants with vouchers. Many landlords who were undecided about accepting vouchers did not know the basics of the program. Forty-nine percent said they do not have enough information about housing choice vouchers, and 37 percent said they are not sure if their rental units qualify for participating in the housing voucher program.

Providing clear information and streamlining the voucher program’s regulations can encourage mom-and-pop landlords to accept vouchers and allow renters to have a larger range of housing options.

More Articles in this Issue

Fresno Housing Authority Serving Homeless Veterans Through Housing

The Fresno Housing Authority won a 2020 Award of Excellence in Affordable Housing for Renaissance…Transit-Oriented Development Brings Neighborhood Revitalization

National Community Renaissance (National CORE) won a 2020 Award of Excellence for Affordable Housing for Encanto Village, a transit-oriented, high-density,…Learning About the World at the Olori Academy in Portsmouth

The Portsmouth Redevelopment and Housing Authority won a 2020 Award of Excellence in Resident and Client Services for developing…Getting People Employed at Yakima Housing Authority

The Yakima Housing Authority, Wash. won a 2020 Award of Excellence in Resident and Client Services for their employment program which…Rising Above the Requirements: Affordable Housing Accreditation

For decades, the affordable housing industry operated under the purview of its largest funder, the…